Would you like currency at this time? You could obtain doing $ten,100 today which have zero borrowing from the bank stress, no software charges, and you may the lowest month-to-month interest! In addition to this, you can get your finances within just 15 minutes!

Voice too good to be true? Oh, it is. Welcome to the industry of the vehicle name mortgage business, the underbelly of one’s financial business, the fresh purveyors out-of loans which have rates of interest excessive they give you vertigo.

For many who individual an automobile which have an effective lien-100 % free term and have now an authorities-provided ID, you can buy a subject financing. What  you need to do is positioned your car or truck upwards getting equity. It doesn’t matter if you may have a credit score from 102 and get an associate-date business that pays minimum wage. No matter whether you will be making $1,a hundred thirty days and then have a hill out of loans. Automobile title lenders usually do not care, along with facts, they will certainly earnings grandly away from you if you only pay the borrowed funds regarding or default with it and you can wake up you to early morning in order to select the car went.

you need to do is positioned your car or truck upwards getting equity. It doesn’t matter if you may have a credit score from 102 and get an associate-date business that pays minimum wage. No matter whether you will be making $1,a hundred thirty days and then have a hill out of loans. Automobile title lenders usually do not care, along with facts, they will certainly earnings grandly away from you if you only pay the borrowed funds regarding or default with it and you can wake up you to early morning in order to select the car went.

Vehicles identity finance are believed by many people experts are the fresh new most severe all of the subprime finance, being those people that are provided to the people who are in need of an excellent little currency having an urgent situation but don’t qualify for perfect price loans from banks. New yearly interest rates in these type of loans can be come to three hundred per cent and significantly more than, for the average vehicles label loan customers taking out a good $950 financing and spending $2140 during the attention charge by yourself.

As to why Is it possible you Want to get a concept Loan

It’s Monday day, and you’re wear your make-up or shaving your mind fuzz, whenever unexpectedly your tune in to a little *pop* and lighting big date. Certain that you are not you to much at the rear of toward electric costs, your call Acme Power company to see if there is certainly an outage in your area. No, they state, there is only fragmented your solution pending a cost of the past-due harmony from $450.

You plead. Your beg. You even cry. Your sit, too: your inform them you may have young kids in the house exactly who you need hot water due to their shower enclosures. Your own granny are upstairs, and she means stamina on her dialysis machine. You really have twelve absolutely nothing baby girls out right back that will die instead of the temperature lighting fixtures. However, Acme Power company will not buy it. Pay out or attend the brand new black the weekend, friend. It’s little individual, simply coverage.

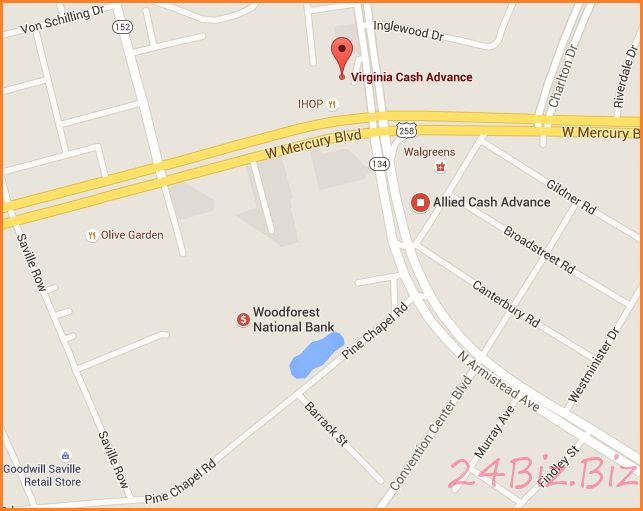

Once the you happen to be one of many 76 per cent out-of Americans just who existence income so you can income, you might be trapped anywhere between a rock and a dark colored domestic, and that means you do exactly what 1.7 mil Us citizens manage annually: You push towards the nearby car name lender, based in a strip shopping mall between a nail salon and you can an effective pets store, while take-out financing that’s probably going wind up sending their blood pressure levels increasing from the of up to the attention rates you’re investing. But now, you have got zero alternatives. The pint from Ben & Jerry’s try melting on the fridge whilst you dot their i’s and get across the t’s.

How Car Identity Fund Works

While you’re filling in brand new identity application for the loan, the lending company inspects the car to choose its well worth, that’s based in area on Kelley Blue Book well worth. It require your ID and maybe a software application costs given that evidence of household, and additionally they may require evidence you have some sort of income. Often, a bank account having minimal profit they is the fresh new evidence they require. Often, you don’t have getting a checking account.